September 19, 2025

Article

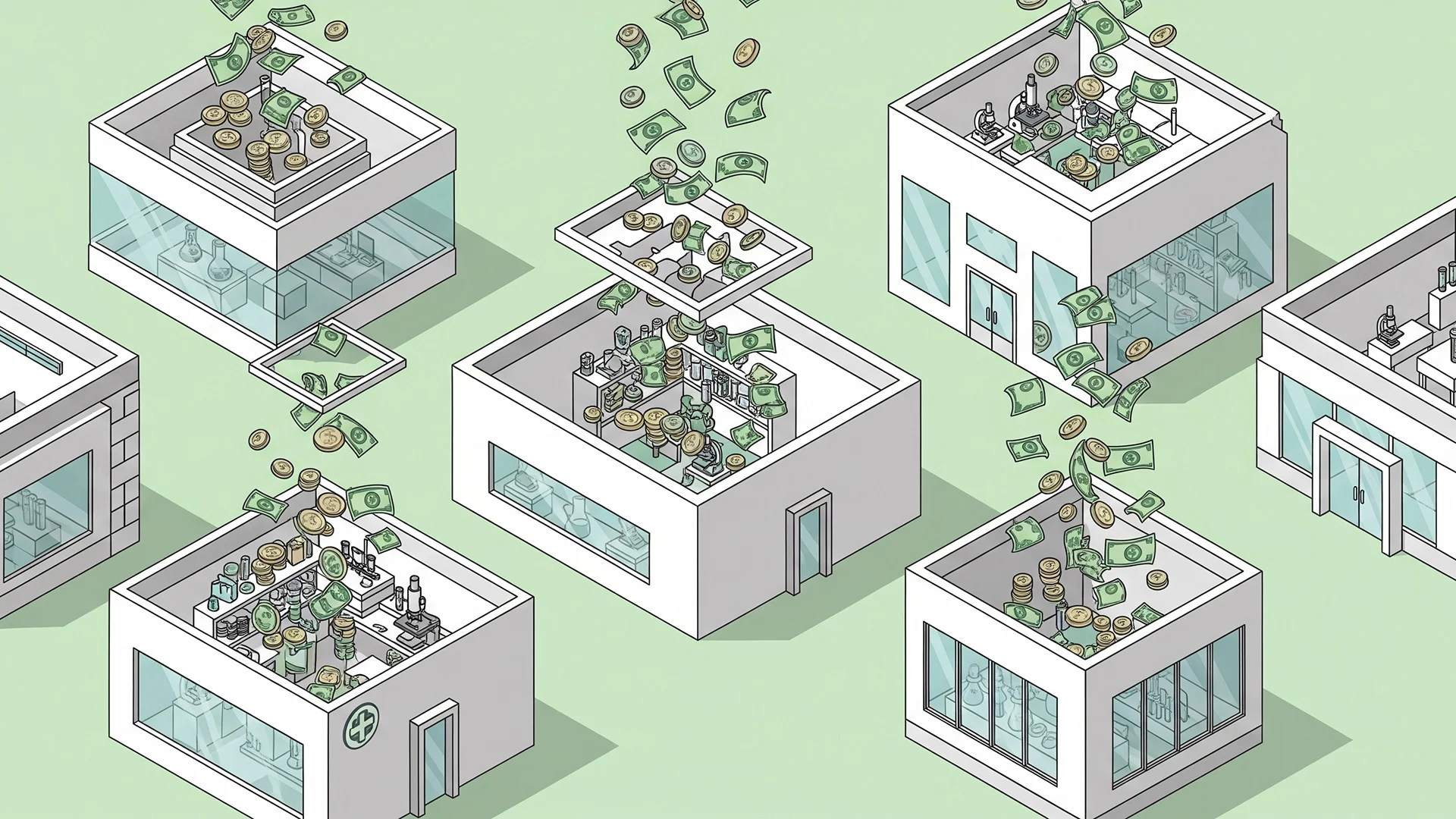

Drugmakers’ Record Factory Expansions Fuel a New Biotech Supply Boom

Cure, Google Gemini

Overview

As pharmaceutical giants pour billions into new U.S. labs and factories, demand rises for equipment suppliers and workforce training.

Biopharma companies are spending heavily on new offices, labs, and large-scale drug manufacturing facilities across the U.S., creating fresh opportunities for startups and entrepreneurs to supply specialized equipment, digital compliance tools and workforce training programs.

Commercial real estate firm CBRE estimated during a recent roundtable discussion that $100 billion to $200 billion in projects are now underway nationwide, a level the firm described as “generational” in scope. Unlike expansions of older plants, many of these investments are going into new sites built from the ground up, with construction costs for some topping $1 billion dollars and hiring plans that stretch into the thousands.

“We’ve seen quite a few new projects announced by multinationals, and many of those large users have gone to new locations to develop their own large-scale production capacity, passing over some available smaller spaces,” said Matt Gardner, Americas advisory leader for life sciences at CBRE, during the roundtable.

Facilities reshape local economies

Global drugmakers are committing hundreds of billions of dollars to U.S. manufacturing. AstraZeneca has pledged $50 billion through 2030, highlighted by a drug-substance facility in Virginia and expansions in Maryland, Massachusetts, Indiana and Texas. Roche has a five-year, $50 billion plan spanning new production sites in Pennsylvania, Indiana and California, alongside a gene-therapy plant and other upgrades.

Novartis is investing $23 billion across ten facilities, from a $1.1 billion research hub in San Diego to new plants in Florida and Texas. Sanofi has set a $20 billion target by 2030, while Gilead is adding $11 billion to an earlier $21 billion commitment, creating about 800 jobs. AbbVie has pledged more than $10 billion, including a $195 million expansion in North Chicago.

Several of the largest investments are centered in North Carolina, especially the Raleigh-Durham area referred to as Research Triangle Park. Recent announcements came from Genentech and Roche, Johnson & Johnson, Amgen, Biogen, Merck, and Novo Nordisk, with combined investments in the billions and thousands of new jobs planned.

Disposable systems gain traction

One of the biggest areas of growth for lab and biomanufacturing supplies is the use of disposable systems, such as plastic bags, tubing, filters and bioreactors that are used once and discarded. The market for these technologies is projected to grow 18 percent a year, reaching $140 billion by 2033.

While in the consumer world, disposable products are generally considered more wasteful than reuseable materials, in biomanufacturing, the chemicals and large amounts of water required to clean and reuse traditional stainless-steel equipment flip that equation. Disposables also lower the risk of cross-contamination between drug batches and shorten the time needed to switch production lines from one medicine to another.

Workforce and training centers expand

Building new plants also requires a steady supply of skilled workers. CBRE data show U.S. life sciences employment reached a record 2.1 million in March 2025 before pulling back slightly. The number of students graduating from colleges and universities with biological and biomedical sciences degrees and certificates hit an all-time high recently, with nearly 175,000 issued in the most recent academic year.

Markets such as Raleigh-Durham rank among the top ten nationally for life sciences R&D talent, supported by universities in the region, though the influx of new facilities and biomanufacturing facilities in recent years has companies scrambling to fill roles. The rapid growth in North Carolina led to a milestone last year, with life science jobs in the state surging above 100,000 jobs for the first time.

“We had already kind of reached the point where 100% of the employers we were surveying a couple of years ago were already saying they cannot find people for the positions,” said Matt Gardner, Americas Advisory Leader for Life Sciences at CBRE.

An ecosystem takes shape

Industry analysts say the effects are spreading well beyond the headline investments. A 2025 report from DCAT Value Chain Insights noted that U.S. companies are ramping up spending not only to add capacity but also to reduce reliance on overseas supply chain. Market research shows that suppliers of disposable equipment, digital quality systems, and training programs are among the fastest-growing segment.

“We are in a transition period, especially in biomanufacturing, where certain geographies have gotten out ahead,” said Ryan Helwig, principal and senior director at TEConomy Partners, at the CBRE roundtable.