Cure, Google Gemini

Overview

Milestone-based financing can be an effective way for investors to manage risk and for founders to complete successful clinical trials and gain regulatory approval. Here's what biotech entrepreneurs need to know before seeking this type of funding.

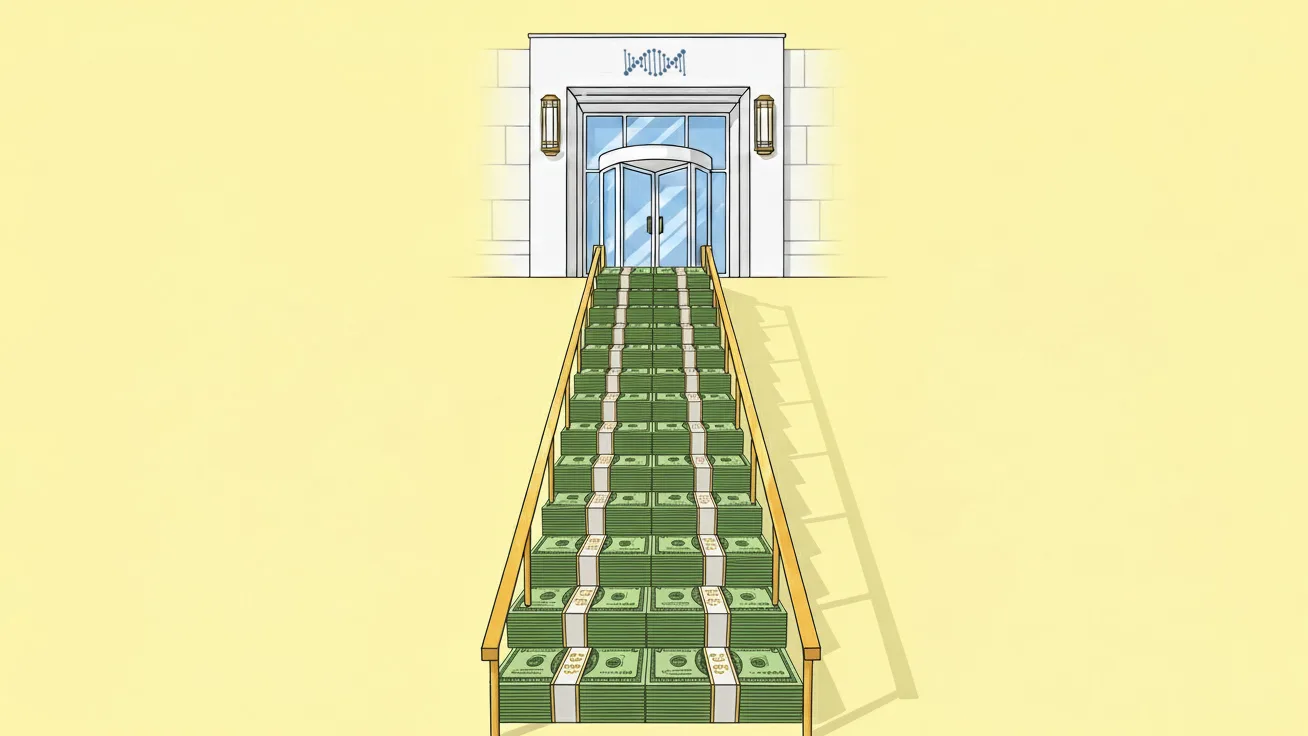

In the high-risk, capital-intensive world of biotech, milestone-based financing can benefit both startups and investors. These deals are designed to reduce financial risk, keep cash flow under control, encourage accountability, link funding to actual progress, and create a structured path for growth.

Whether or not to pursue milestone-based financing is a decision many biotech founders must make for themselves. To guide that choice, here are some important considerations to make when weighing your investment options.

The role of milestone-based funding in translational biotech startups

Along with VC funding, accelerators, incubators, and crowdfunding, milestone-based financing is one way healthcare startups can raise money. In biotech, it's especially common because it helps cover costs for lab experiments, preclinical trials, and IND-enabling studies.

Unlike traditional VC rounds, where the full investment is made upfront, milestone-based fundraising happens in set stages tied to specific goals or achievements. Each time a milestone is reached, investors release additional funds. In later-stage development, large pharmaceutical companies may partner with the startup to fund later trials, submit to regulatory agencies like the FDA, and eventually bring the drug to market.

Jason Spark, Chief Biotech Officer at Inizio Evoke, noted, "There's a robust pool of investors and venture capital that is familiar with investing in the space, and knows how to invest in the space, and knows generally what the path to value creation is."

For investors, milestone-based fundraising offers clear advantages. It reduces risk by funding companies step by step, while also improving cash management since startups can only access funds after reaching milestones. This structure also keeps founders engaged and accountable, motivating them to hit goals on time and regularly communicate their progress.

Jim Polson, Senior Managing Director and Head of Healthcare & Life Science Financial Communications practice at FTI Consulting, explained that compared to other financing approaches or IPOs, milestone-based financing is a safer option for both companies and investors.

"It not only allows investors to align their interests more closely to the company's strategic plans but also provides greater resource management between investors and leadership," Polson added.

Understanding how milestone-based financing deals are structured

While every milestone-based financing deal is unique, most are structured around clearly defined points of scientific or regulatory progress. Some common milestones for translational biotech startups include proof of concept, IND-enabling studies, and first-in-human trials. Startups developing drugs naturally have these milestones, unlike apps or digital startups.

According to Spark, milestone-based financing takes on a different form depending on the stage of drug development. For example, the funding structure and expectations will be very different if a company is still in early discovery compared to when it has already selected an IND candidate or moved into first-in-human Phase I or Phase II trials. Each stage presents different risks and data requirements that investors consider when structuring deals.

A great example of this is Ottimo Pharma. This biotech startup raised over $140 million in a Series A round aimed specifically at advancing IND-enabling studies for its lead bifunctional antibody, Jankistomig. Another company, Biolojic Design, structured its agreement with Teva so that milestone payments were tied to initiating IND-enabling studies.

How to frame and communicate milestone-based funding

In Polson's experience, how a company frames milestone-based financing plays a crucial role in its reception by investors, employees, and the public. What works best, he said, is when companies present it as a strategic and more controlled way to raise capital.

"Whether it is a startup or an established, multinational organization, I always emphasize to leaders the importance of developing a differentiated equity narrative that articulates the organization's financial performance, strategic vision, and long-term growth potential," Polson shared.

Both Spark and Polson agree that clear, consistent communication is essential. Regular updates that demonstrate progress help manage expectations and build credibility.

"During a milestone-based financing round, it is even more critical to communicate in a way that is transparent, concise, and dynamic to ensure employees, investors, partners, and other stakeholders understand the situation and any implications if the goals are missed," Polson said.

For investors in particular, transparency is a bridge toward long-term trust. Leaders should be ready to explain how the deal works, the potential risks, and why the leadership team is confident in the company's direction.

"Messaging should emphasize leadership's track record, established and confirmed clinical data, and accurately convey the next steps for the deal and/or pipeline without creating unrealistic expectations," Polson added.

What to do if a milestone is delayed or missed

Even with careful framing and regular updates, milestones can sometimes be delayed. "It's science, and you can't predict all of it, so things inevitably change," noted Spark.

When this happens, the most significant impact is usually on the startup's cash runway. "In those situations, you think about how this impacts strategy and whether you need to reallocate resources," Spark shared. For some leaders, this might mean slowing down another program or reallocating resources from one project to keep the lead program on track. "Those are just decisions that need to be made," Spark stressed.

Polson agreed and added that missing or delaying a milestone can also weaken a company's credibility. To reduce this risk, milestones should be set realistically and communicated transparently. "Companies should provide routine updates with stakeholders as they progress and be transparent about any challenges or setbacks, particularly if the milestone is a pivotal clinical trial readout or a regulatory update," Polson explained.

Scenario planning can also ensure there's a clear strategy in place if a goal is missed. It's a way to keep partners, investors, and employees engaged while minimizing reputational damage. "By being open, honest, and timely with stakeholders, leaders can maintain trust and credibility, even in the midst of unexpected obstacles," he added.